***

For a summary of the rankings of our entire convertible debenture coverage universe including the quantitative model prices of, and notes on each issue we follow, click on the table below to view it larger.

Important: Like everything else on this website, content here is provided as information and opinions only and not intended to be a provision of investment advice or a recommendation of any investment action in any form. There is no guarantee, warranty, representation, or other assurance whatsoever on any of the information provided. Information and opinions reflect our views as of the date provided, but may change without notice. Investments made in convertible debentures are exposed to the risk of financial losses, and as with all disseminated information concerning investments, it is highly recommended that an individual consult with a qualified investment professional before making any investment decisions.

Public Service Message: A New Convertible Debentures List

So where does that leave us convertible debenture investors?

Well, in an attempt to address this absence for the convertible debentures community, we decided to go to work and came up with the Peanut Convertible Debentures Big Board, which you can access here. No, it's not a complete list of Canadian convertible debentures, but it is a bigger list than the one we have for the Peanut Power Rankings, and hopefully at least some of you out there will find it useful.

Market Commentary - Quick Points (March 29, 2019)

- After a hot January and February, Canadian equities took a relative breather in March. Canadian equities, as measured by the S&P/TSX Composite Index, was up approximately 0.64% on a price basis, after adding 12.13% in the first two months of the year alone.

- In some ways, the positive performance by the TSX was somewhat surprising in light of the suddenly anemic-looking economic data being released. Clearly, the Canadian economy has slowed, and a technical recession isn't impossible in the near future. Bond yields plunged during the month, and here we are again, staring at a sub-1.5% 10-year Canada bond.

- Although Stephen Poloz and crew sometimes like to surprise, it's hard to see the Bank of Canada raising interest rates in 2019. In fact, a rate cut before the middle of 2020 is more likely than a rate increase - just my opinion. As per usual, economic data will drive the decision but I struggle to find any catalysts that will cause positive economic surprises. Trade is lumbering thanks to tariff-men and protectionist bents outside Canada, and NAFTA 2.0 (or CUSMA or whatever it's officially called) is still not ratified. China remains cold on Canadian goods (with canola being the latest victim) thanks to political considerations. Our federal government remains mired in the SNC-Lavalin scandal. Real estate in Vancouver and Toronto have slowed. I'm unsure of further upside in Canadian oil prices. And, of course, the flat-and-low yield curve means challenging net interest income generation for our stalwart banks and insurance companies.

- Ok, so that's a laundry list of bleak. At this point, the prospect of easier monetary policy seems to be the only thing driving equities, and we're back at the old TINA (a.k.a. there-is-no-alternative) trade, which makes me a bit uncomfortable.

- In this type of environment, convertible debentures held their own, however. As measured by our homegrown Peanut Convertible Debentures Index™, Canadian convertible debentures added a modest 0.35% in March, bringing the year-to-date return of the index to 4.64%.

- In the very near future, I'm a bit cautious, but accept that equity markets (and convertible debentures) can go further from here. Valuations in Canada aren't ridiculous, and I tend to think that relative to US and international markets, Canada isn't getting full respect right now. As you investors know, fads change and pendulums swing, and at some point, Canada will be en vogue once again. That said, we repeat ourselves like a broken record once again with the general themes of staying diversified, emphasizing higher quality issues, and remaining focused on the long-term. In addition, having a bit of cash on hand to take advantage of any unforeseen (or foreseen) market shocks is also an idea. As per usual, good luck investing out there.

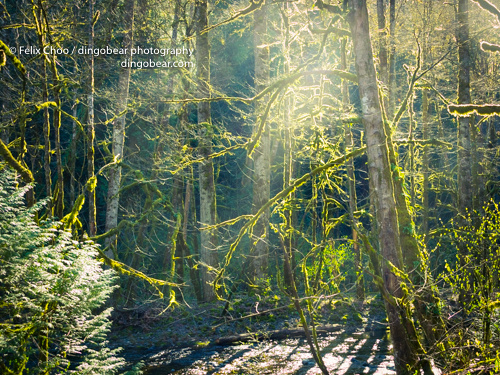

The enchanted rainforest. Goldstream Provincial Park, Langford, British Columbia. Copyright © 2019 Felix Choo / dingobear photography. Photo may not be reproduced without permission.

Drop Us a Line, Drop Us a Dime

Thank you for reading The Canadian Convertible Debentures Project. As always, if you have any comments, questions, or feedback about convertible debentures and/or this blog, please leave us a comment at the bottom of the page or email us at convertibledebs@gmail.com. Note it may take us a few days to get back to you depending on our schedules.

In addition, for media, sponsoring, and/or financial institution inquiries, please email us at convertibledebs@gmail.com. We appreciate your interest!

If you enjoy reading this blog and find it useful and valuable in your own investing in convertible debentures, we'd be humbled if you'd like to make a contribution to support us in our mission of making quality, independent, Canadian convertible debentures content freely available to all investors, big or small, out there. We thank you for your continued support!

***