A female tree swallow (Tachycineta bicolor). Beaumont, Alberta. Copyright © 2019 Felix Choo / dingobear photography. Picture available for licensing at Alamy Images. Photo may not be reproduced without permission.

***

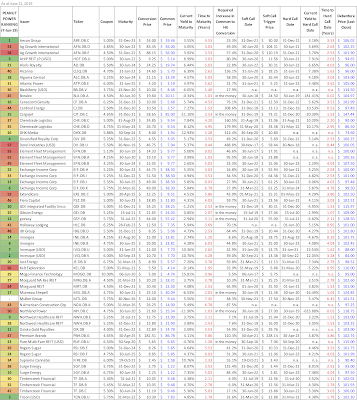

Happy summer solstice! This is the 15th update of the Peanut Convertible Debentures Big Board, with data current to June 21, 2019. For previous versions of the Peanut Big Board, please click here.

Important disclaimers: Like everything else on this website, content here is provided as information and opinions only and not intended to be a provision of investment advice or a recommendation of any investment action in any form. There is no guarantee, warranty, representation, or other assurance whatsoever on any of the information and opinions provided. Information and opinions reflect our views as of the date provided, but may change without notice. Investments made in convertible debentures are exposed to the risk of financial losses, and as with all disseminated information concerning investments, it is highly recommended that an individual consult with a qualified investment professional before making any investment decisions.

A Few Words about the Peanut Convertible Debentures Big Board

For those of you new around here, the Peanut Convertible Debentures Big Board is our attempt at providing a larger list of convertible debentures. The Peanut Big Board contains some of the same information you'll find in our popular Peanut Convertible Debentures Power Rankings, and this version covers 59 different convertible debenture issues.

Note the Peanut Big Board is not a complete list of all Canadian convertible debentures, nor is it a replacement for the Peanut Power Rankings, which is more detailed and provides notes and a quantitative estimate of the relative value of the convertible debenture issues that are covered over there. We know that the Peanut Big Board isn't a perfect solution to those of you looking for a carbon copy of the list that used to reside on the pages of the Financial Post, but hopefully you will find utility in its publication here nevertheless.

Let's get to it. For the Peanut Convertible Debentures Big Board, please click on the table below to read it larger. If you still find it too small to read, please download the PNG file, which then can be zoomed to a size that you prefer.

Drop Us a Line, Drop Us a Dime

Thank you for reading The Canadian Convertible Debentures Project. As always, if you have any comments, questions, or feedback about convertible debentures and/or this blog, please leave us a comment at the bottom of the page or email us at convertibledebs@gmail.com. Note it may take us a few days to get back to you depending on our schedules.

In addition, for media, sponsoring, advertising, and/or financial institution inquiries, please email us at convertibledebs@gmail.com. We appreciate your interest!

If you enjoy reading this blog and have found it useful and valuable in your own investing in convertible debentures, we'd be humbled if you'd like to make a contribution to support us in our mission of making quality, independent, Canadian convertible debentures content freely available to all investors out there, big or small. We work hard to provide you with good quality information on convertible debentures that may be difficult to source elsewhere.

If you're interested in contributing, please click on the "donate" button below and follow the instructions. Donations to this blog may be made by credit card or PayPal, and are processed by PayPal as a third-party on a secure platform; we don't ever see or access your credit card number. We thank you for your continued support - we really appreciate it!

***